are non profits 1099 reportable|Information returns (Forms 1099) : Clark E-file Form 1099 with the Information Returns Intake System (IRIS) for tax year 2022 and later. The tax-exempt organization will need the social security number or EIN of an independent contractor to complete Form 1099-MISC. Imrei Emes, 1886"By donating to Kupath Rabbi Meir, every person can be helped with whatever they need."; Rabbi Moshe Feinstein, 1964"I recommend wholeheartedly donating generously to Rabbi Meir Baal Haness Kollel Polin because you cannot fathom the tremendous zchus." At fifth Knessia Gedola of Agudath Israel World Org., Jerusalem; .

are non profits 1099 reportable,E-file Form 1099 with the Information Returns Intake System (IRIS) for tax year 2022 and later. The tax-exempt organization will need the social security number or EIN of an independent contractor to complete Form 1099-MISC. Nonprofits must keep accurate records of their financial activities to prepare and file Forms 1099 at the end of the calendar year. This includes tracking payments to .

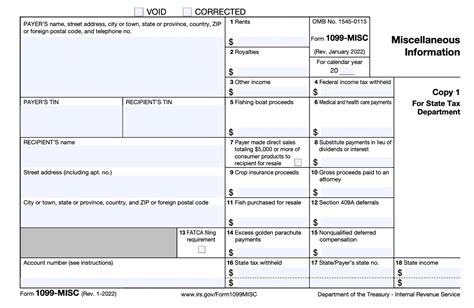

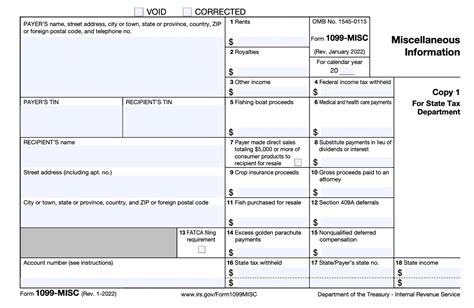

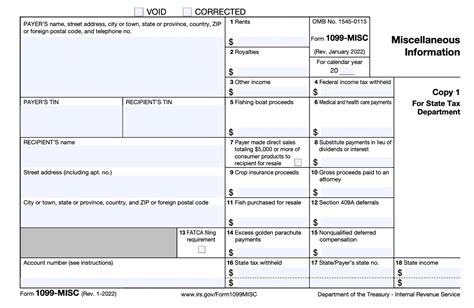

Do Nonprofits or Churches Need to Complete 1099s? written by Aplos Success Team. Any organization that meets the filing requirements is required to complete 1099s, regardless of tax-exempt . Form 1099 for Nonprofits: How and Why to Issue One. Monday, December 11, 2023. Nonprofit Management Nonprofit Tax For Executive Directors For Nonprofit . A Form 1099 is issued to taxpayers so they may provide information to the Internal Revenue Service (IRS) about different types of non-employment income received during the tax year. This income. Nonprofits often deal with various types of 1099 forms, each serving a specific purpose: 1099-NEC: Used for reporting non-employee compensation of $600 . Answer: Grants made to nonprofit organizations are usually not subject to Form 1099 reporting because nonprofit payees typically fall within certain exceptions .

are non profits 1099 reportableInformation reporting, such as on Forms 1099 or W-2, is one of the crucial components of a well-functioning tax system. Such information reporting both assists taxpayers in filing .A taxpayer or business that reports charitable donations to nonprofit organizations can deduct the amount of his donations from his taxable income, which may reduce the . Dividends or other distributions to a company shareholder (Form 1099-DIV) Distribution from a retirement or profit plan or from an IRA or insurance contract (Form 1099-R) Payments to merchants or other entities in settlement of reportable payment transactions, that is, any payment card or third party network transaction (Form 1099-K)

Form 1099-NEC, on the other hand, is used to report payments of $600 or more made to independent contractors and other non-employees. There are several types of IRS 1099 forms, including 1099-A . The 1099-K is an IRS tax form used to report electronic and third-party network transactions, including payments via debit cards, credit cards, and payment platforms like PayPal or Venmo. Previously, you only received a 1099-K if you received over $20,000 from third-party payment platforms or electronic transactions.

Information returns (Forms 1099) When selling a noncovered security and reporting it on a separate Form 1099-B, you may check box 5 and leave boxes 1b, 1e, 1f, 1g, and 2 blank. If you check box 5, you may choose to report the information requested in boxes 1b, 1e, 1f, 1g, and 2 and will not be subject to penalties under section 6721 or 6722 for failure to report this . Although the accountable plan rules were developed in the context of employee expense reimbursements and Form W-2 reporting (and this Q&A will presume that the Board members and volunteers are not required to be treated as employees here), there is good reason to think the same treatment applies to most travel-related expense .

As such, need-based financial assistance is not reportable on Form 1099 or any other similar tax form. There are certain disclosure requirements in the Form 990 for grants to individuals, but the disclosures do not involve identification of individual grantees.” . Cash vs. Non-cash Assistance. Charitable assistance may be in the form of a .

Form 1099-NEC is required to be filed with the Internal Revenue Service (IRS) on or before February 1, 2021 – using either paper or electronic procedures. File Form 1099-MISC with the IRS by March 1, 2021 if you file on paper, or by March 31, 2021 if you file electronically. Copies should be sent to payees for each Form by February 1, 2021 .

Thus, it is likely that the cash grants paid by your organization to financially distressed families qualify as non-taxable gifts under Section 102 and therefore should not be reported on Form 1099. For information on whether a Form 1099 must be issued for a grant made to a nonprofit organization, check out Q&A #96.are non profits 1099 reportable Information returns (Forms 1099) Nonprofits often deal with various types of 1099 forms, each serving a specific purpose: 1099-NEC: Used for reporting non-employee compensation of $600 or more, including payments for services performed by non-employees and attorneys. 1099-MISC: Covers miscellaneous income like rent, royalties, and other payments, including . Forms 1040 - 1099; Form 1099: Reporting Non-Employment Income. . Distributions from Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. Understanding your Form 1099-K. Form 1099-K is a report of payments you got for goods or services during the year from: These organizations are required to fill out Form 1099K and send copies to the IRS and to you. Payments you got from family and friends should not be reported on Form 1099-K. Use Form 1099-K with other records to .

Reporting. A sponsor must report more than $600 in nonqualified payments made to a sponsored individual annually by filing Form 1099 MISC with the IRS. The sponsor will send another copy of the form to the person by the end of January the following year. The individual must then file Form 1040, Schedule C and Schedule SE to report the income .January 7, 2015. The requirements for preparing and filing information returns, such as Federal Forms 1099 and W-2, apply to all businesses, including Exempt Organizations. In fact, on page 5 of the Form 990, .2004, the return would be due January 31, 2005). Separate tax deposit s are required for p ayroll and non-p ayroll withholding. Be sure to mark the Form 945 checkbox on Form 8109, the Federal tax deposit coupon. The organization must list the EIN (employer identification number) of the organization conducting the raffle on Forms W-2G, 1096, and .

Information reporting, such as on Forms 1099 or W-2, is one of the crucial components of a well-functioning tax system. . Most non-profits are familiar with the information reporting rules requiring Form 1099 to contractors, but when the payment is made to an overseas contractor (who typically will not have a Social Security Number) questions .For more information regarding reporting non-employee compensation and exception to reporting refer to the Instructions for Forms 1099-MISC and 1099-NEC PDF. If you file Forms 1099-NEC on paper you must submit them with Form 1096, Annual Summary and Transmittal of U.S. Information Returns. If you file more than one type of information .

Nonprofits follow the same rules for sending 1099s as for-profit corporations. Give contractors a W-9 to fill out. If they're incorporated, you don't usually have to send them a 1099. Otherwise .There are different 1099 form types, but the 1099-NEC and 1099-MISC are the most common ones. 1099-NEC is used to report non-employee compensation, while IRS form 1099-MISC reports the miscellaneous income payments. . 1099-DIV for reporting cash payments for dividends, 1099-R for pensions and payouts from IRS and 1099-S for that .

are non profits 1099 reportable|Information returns (Forms 1099)

PH0 · What Are the Nonprofit 1099 Rules?

PH1 · Understanding 1099 For Non

PH2 · Tax Information Reporting for Non

PH3 · Q&A #96 – Must a Form 1099 be issued for a grant made to a nonprofit

PH4 · Q&A #96 – Must a Form 1099 be issued for a grant made to a

PH5 · Information returns (Forms 1099)

PH6 · How Are the Payments to Nonprofit Organizations Reportable?

PH7 · Form 1099: Reporting Non

PH8 · Form 1099 for Nonprofits: How and Why to Issue One

PH9 · Essential nonprofit tax compliance: Understanding 1099 Forms,

PH10 · Do Nonprofits or Churches Need to Complete 1099s?